Cogitatio 40 – T-7A Market Outlook: Positive but Increasingly Fragmented

Since Boeing’s not so unexpected capture of the USAF T-X market, we have been reviewing the potential of this aircraft with interest since it will represent a significant test for Boeing ahead of the F-18, F-22 and F-15 recapitalization programs.

T-X is a multifaceted effort – a new (and critical) production system, a new way to develop and produce an light jet aircraft (thank you Saab), a new training system, new supply chain engagement, new approach to rapid technology insertion plans and capabilities development.

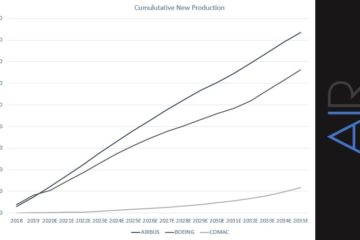

The next two decades will also be characterized by major market access challenges for Boeing and the United States. In this forecast note, we have selected to look only at the market accessible to the T-7A and thus have omitted such markets as China and Russia that we would normally included.