AIR 144 – “We have got a wicked shimmy with our forecast”

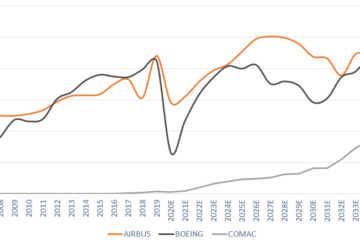

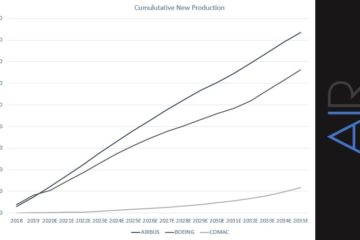

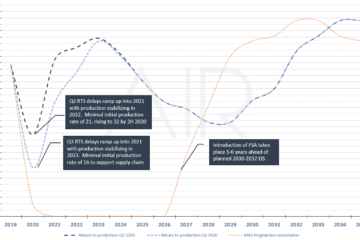

As we finalize an “unscheduled” post January 5 revision of our long-range forecast, we have yet to fully firm up some of the numbers due to a higher degree of uncertainty with the following elements:

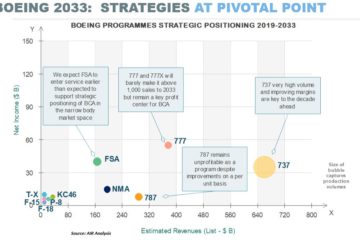

The sequencing of the next-generation narrowbodies at Airbus and Boeing. We currently assume that the entry-into-service (EIS) of both OEMs will be timed closely before 2035.

Boeing’s midmarket aircraft will likely be relaunched at some point. The need is acute, and the 787 is too expensive and…